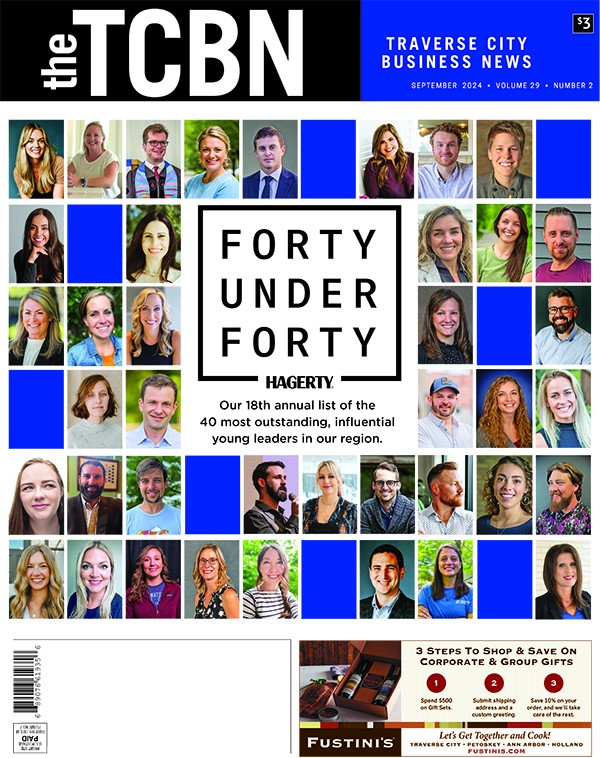

Commercial Roller Coaster: Local commercial real estate experts talk trends in office, restaurant/retail, industrial markets

August 2024

For good reason, northern Michigan’s residential real estate market tends to be the subject of near-constant discussion and analysis. Where are home prices landing right now? What do the inventory numbers look like? Who’s buying and selling? What properties are attracting bidding wars or big way-above-asking-price cash offers?

While the housing market is one of Traverse City’s most hot-button topics, it’s not the only real estate market that merits attention. From office buildings to retail and restaurant spaces to industrial parks, northern Michigan’s commercial real estate market has gone through its own major swings in the past few years, with the gig economy, the pandemic, local labor shortages, high interest rates, and financial trouble for national chains all sending significant reverberations through the local market.

To see where things stand in local commercial real estate, we touched base with three experts: Dan Stiebel of Coldwell Banker Commercial Schmidt Realtors, Marty Stevenson of EXIT Realty Paramount, and Kevin Query of Three West. Here’s what we learned.

The big picture

Both locally and nationally, commercial real estate started the decade off on the wrong foot. As COVID-19 descended on America, a mixture of business closures, work-from-home pivots, stay-at-home orders, and general pandemic anxiety caused the U.S. commercial property market to crater.

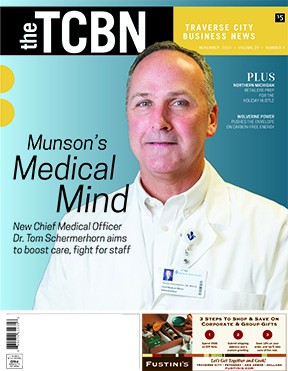

Stiebel

StiebelIn July 2020, Bloomberg reported that commercial real estate transactions for the second quarter of that year were down a whopping 68% from Q2 2019. And by September, the Commercial Real Estate Development Association was ready to dub the COVID-19 pandemic worse for the commercial real estate market “than the global financial crisis of earlier in this century.”

But the market has been steadily recovering ever since, with many employers bringing their workers back to the office and with lessened pandemic anxiety bringing the action back to bars, restaurants, retail stores and other public-facing businesses.

According to Stiebel, the bounce-back has continued into 2024. For the first half of the year, he reports that total sales volume for commercial properties in Grand Traverse County was up 30% year-over-year, and total listings sold was up 26%. Lease transactions, meanwhile, are mostly staying steady, with 62 commercial units leased in the first half of the year, compared to 65 for Q1 and Q2 last year. High demand is also driving increases in average sale price and price per square foot (both up 4%) and decreases in days on market (down 4%, or 10 days) from where they were a year ago.

If these numbers prove anything, it’s that rumors of commercial real estate’s demise were highly exaggerated. However, our experts warn that, while numbers are up in the big picture sense, that doesn’t mean every segment of the market is performing well.

The office market

Query once called commercial office space “the biggest loser of 2020” – a big claim that nonetheless may have been accurate.

In Q4 2020, the U.S. office market “recorded the first instance of more than 40 million square feet of occupancy losses in a given quarter,” per the Chicago-based Jones Lang LaSalle, a global commercial real estate services company. In total, tenants across the country vacated some 84 million square feet of office space in 2020, bringing the total industry-wide vacancy rate to an unprecedented 17.1% by the end of 2020.

Traverse City saw its own fair share of vacancies pop up during the pandemic – most notably with Hagerty, one of the area’s largest employers, vacating huge pieces of its once-dominant downtown office footprint. According to Stiebel, the aftershocks of that peak-COVID period are still being felt throughout the TC office market, especially in the downtown core.

“I can think of at least four buildings downtown that have converted their upstairs into residential,” Stiebel says, pointing to former office spaces in the Masonic Building and the Beadle Building as examples. “There’s a lot of demand for places to live downtown, or for short-term rentals, and the office market is still comparatively soft. There are still a lot of vacant spaces from where Hagerty has vacated, and those aren’t the only vacancies, either. For instance, the Bank of Northern Michigan building, since Huntington pulled out, that one has also been sitting empty.”

Despite the high-profile vacancies, Stiebel assures that the office market is in a better place than it was a few years ago. Between Q1 and Q2 2024, 13 office spaces were sold in Grand Traverse County – up from just seven for the first half of 2023. On average, those properties commanded a $230 per square foot sale price – higher than any other commercial real estate segment, save restaurant space.

“The bigger spaces are sitting on the market because they’re just more difficult to sell or lease,” Stiebel says. “For the most part, those properties have a tenant who is still paying the rent, so the landlords aren't as motivated (to find a new tenant). And then they're also larger spaces, so they're more difficult to lease out without dividing them.”

Stevenson agrees that size is the driving factor in what’s selling or leasing across Grand Traverse County’s office market and what isn’t.

“Smaller office units remain in demand, which continues the years-long trend sprouted by the gig economy and strengthened after COVID,” he said. “The local market for larger offices has slowed over the past few years, with the lion’s share of larger office spaces taken on by medical users, and mid-size offices maintaining a somewhat healthy outlook thanks to financial institutions, title companies, real estate brokerages, and others. If larger office spaces can be easily converted into smaller spaces, it behooves the owners to list the property with such options.”

While Stevenson sees more conversions coming down the pike, he says that anyone worried about more short-term rental conversions shouldn’t fret too much.

“Converting to residential or short-term rentals is a costly endeavor that is restricted to only a few zoning districts,” Stevenson said.

Restaurant/retail space

According to Stiebel’s data, there was only one restaurant sale in Grand Traverse County during the first six months of 2024, and just seven retail units sold. Leases are slightly higher – 12 leasing transactions in the retail segment across Q1 and Q2 – but are still down 45% from the same period last year.

On the restaurant side, Stiebel says he’s dealt with multiple clients who had “planned to open restaurants” in northern Michigan but have put those plans on hold “because of staffing issues.” He sees a connection between the dip in office occupancy downtown and the decline in demand for restaurant properties in the area.

“It used to be that we had a lot of choices of places to go get lunch downtown; now, a lot of restaurants are only offering dinner,” Stiebel said. “The reasons are twofold. One, it's still a difficult labor market, so the existing restaurants don't have the staff to cover lunch hour. And two, even restaurants like the Pie Company, which are traditional lunch places, I think they're struggling more than they used to because they don't have the volume of people coming downtown to work.”

“The restaurants we do have, I think they pivoted and survived very nicely,” Stiebel continued. “But it's still expensive real estate to do it only on dinner.”

Staff shortages and the changing patterns of restaurant traffic have also changed the type of space that would-be restaurant operators are looking for.

Stevenson

Stevenson“Many restaurateurs are seeking smaller dining areas – or none at all – yet those spaces are scarcely available,” Stevenson said.

Stiebel agrees, and points to excessive square footage as the primary reason many restaurant spaces outside of Traverse City’s downtown core have sat on the market for months or even years at a time. In Leelanau County, for instance, restaurants like Fischer’s Happy Hour Tavern in Northport or the Cedar Tavern have struggled to find buyers. Both are larger spaces from a different era of restaurant design.

“In my experience, the restaurants that have opened recently tend to have smaller spaces and smaller staffs of 20 or under,” Stiebel said. “We're not really seeing the larger restaurants that require 100-plus people to run them.”

It’s not just restaurateurs that are hunting for more compact real estate. Stevenson says smaller footprints are also all the rage among retail buyers – especially for brand-new businesses that haven’t established a clientele or made a name for themselves yet.

“The now-shelved downtown retail incubator that had been planned by the Traverse City Downtown Development Authority (DDA) would have been a tremendous asset to fledgling retailers in this new economic environment,” Stevenson said.

The DDA killed the incubator concept in July, amid concerns about funding and staffing the incubator given the uncertain future of TIF 97. The organization had been trying to bring a retail incubator to downtown TC since at least 2021, with the goal of providing a bridge that newer operators could take between pop-ups or food trucks and permanent brick-and-mortar stores.

Unfortunately, the lack of demand for large-footprint spaces is coming at a time when failing national retailers are leaving many of those properties up for grabs.

That trend isn’t necessarily new: Over the past decade, Traverse City has bid farewell to stores like Kmart, MC Sports, Toys R Us, Younkers, and Sears, all of which leased sizable buildings. This year will see another big exit: In June, the drugstore chain Rite Aid announced a round of 12 closures across the state of Michigan, due to struggles with bankruptcy. Several of those locations are in northern Michigan, including a newly built space at the corner of Front Street and Garfield Avenue that Rite Aid moved into less than five years ago.

Stevenson thinks the exodus of Rite Aid – particularly in that newer building – might cause developers pause as they consider building those types of large commercial spaces in the future.

“We’ve seen retailers come and go, and any new builds may want to keep in mind that their initial tenant might not be their tenant for long,” Stevenson said, noting that, in the case of national chains like Rite Aid, “the building is typically designed specifically for that initial tenant.”

“Retail spaces are typically wide-open boxes produced for a single user, making large retail spaces costly to renovate into multi-tenant buildings,” Stevenson said. “Think entrances, HVAC, plumbing, electrical, etc.”

Locally, developers have had some success turning former big box stores into new, innovative projects. Take the Cherryland Mall, now redubbed the CLEAR Center and envisioned as a community hub that will include current tenants like the Traverse City Curling Club, the Traverse City Philharmonic, and a K1 Speed indoor go-kart center – as well as future possibilities like 24/7 golf, a trampoline park, or a roller rink. The former Kmart in Acme is another example: It’s now a multi-use development that will eventually encompass pickleball courts, office space, a coffee shop, a fitness center, warehouse space and apartments.

For his part, Stevenson says he doesn’t see similarly innovative possibilities taking form at the soon-to-be-vacant Rite Aid space.

“Hopefully, a national retailer will take advantage of the new building and prime location, as other larger buildings that have been converted from their single-tenant uses have the benefit of more options based on the size of their parcels,” he said.

The industrial sector

If there’s a silver lining to northern Michigan’s rather checkered commercial real estate report, it’s the industrial market.

"The industrial segment has been the most consistently strong sector of our local real estate market during my 10 years as a commercial realtor,” Stevenson shared.

While there have been some “peaks and valleys,” Stevenson thinks the area’s robust manufacturing sector, as well as the focus of local economic development leaders on building Traverse City into a thriving tech hub, will continue to drive demand for industrial real estate going forward.

“A new development, such as the technology and logistics park being discussed near the airport, will certainly improve the outlook for companies eyeing our market, given that no large-scale ‘traditional’ industrial parks have been built in our area for quite some time,” Stevenson said. “Regardless of what happens with that project, I’d expect the local industrial market will remain strong into the foreseeable future.”

While Stiebel has observed some signs of “softening” in the local industrial market in recent years, he mostly blames high interest rates and low inventory.

“That’s coming off of our greatest period of demand we've ever seen for industrial,” Stiebel said of the slight dip. “Industrial had a huge run up until the interest rates started climbing. For both industrial sales and leases, any time something came on the market, it was snapped up immediately. Now, we're seeing a little bit of availability again. Companies are asking, ‘Do we want to see what's going to happen before we expand?’ But I would imagine demand will pick up again in a year or two, when interest rates come down.”

Query

QueryThe future

Interest rates are certainly the elephant in the room when it comes to predicting what the future might hold for northern Michigan’s commercial real estate market. Right now, Query says the commercial market in northern Michigan “is getting a bit jammed up” with low inventory problems – a series of kinks that likely won’t be worked out until interest rates drop.

“There are sellers out there that are interested in selling their properties, but you’re seeing some pretty high expectations on pricing from those sellers,” Query explained. “In this area, there isn’t really any distress that would force sellers out of their properties, so most sellers aren’t in a position where they have to accept a lower price than what they expect. And then, on the buying side, interest rates are starting to bite. At the asking prices sellers are expecting, most projects simply do not pencil.”

Query also doesn’t expect new construction to solve the inventory problem, citing a lack of skilled trades in the area as the cause of “stubbornly high” building costs. He predicts inventory will stay "tight and keep prices elevated” until interest rates drop.

Are those drops imminent? Stiebel thinks one or two interest rate cuts are coming before the end of the year, and while he doesn’t expect those cuts to be big, he does anticipate they’ll get the commercial real estate market moving a bit faster.

Stevenson, meanwhile, doesn’t think there will be any big shifts in the market until inflation trends turn around.

“Think to back a few years when gas was around $2 per gallon, a burger and fries at a sit-down restaurant was $10, and you didn’t have to shop online to find deals,” Stevenson said. “The costs of all goods are up, the discretionary funds for most people are down, and that combination makes it hard for all businesses to flourish.”